Introduction

In today’s fast-paced and digitally-driven world, having efficient and reliable accounting tools is crucial for any business to succeed. With the rise of online accounting, traditional methods of bookkeeping and financial management are quickly becoming outdated. That’s where Xero comes in. This innovative accounting software offers a wide range of tools and features to help businesses of all sizes streamline their financial processes and unlock their full potential. In this blog post, we’ll take a closer look at how Xero’s online accounting software tools can benefit your business and elevate your financial management game.

Understanding Xero’s Revolutionary Approach to Accounting

In the world of finance, small businesses often struggle to find efficient and cost-effective ways to manage their financial processes. Traditional bookkeeping methods can be time-consuming and prone to error, hindering the growth and success of these businesses. That’s where Xero’s revolutionary approach to accounting comes in.

Xero offers a comprehensive suite of accounting software tools that are specifically designed to meet the unique needs of small businesses. Unlike traditional accounting systems, Xero is cloud-based, meaning it can be accessed anytime, anywhere, and from any device with an internet connection. This allows small businesses to stay connected and on top of their finances at all times.

But Xero’s revolutionary approach goes beyond just accessibility. The software is designed with user-friendliness in mind, making it easy for even those with little to no accounting experience to navigate and utilize its features. With Xero, small businesses can effortlessly manage invoices, track expenses, and reconcile bank transactions, all from one centralized platform.

Another key feature that sets Xero apart is its real-time financial reporting capabilities. This means that small businesses can generate up-to-date financial statements and reports at the click of a button, providing them with valuable insights into their financial health. This information is crucial for making informed business decisions and planning for the future.

By embracing Xero’s revolutionary approach to accounting, small businesses can save time, reduce errors, and gain a better understanding of their financial performance. With the power of Xero’s accounting software tools at their fingertips, small businesses can focus on what they do best – growing and succeeding in today’s competitive marketplace.

Financial Management Features That Matter

As a business owner, effectively managing your finances is a top priority. That’s where Xero’s financial management features come into play. With these tools, you can streamline your financial processes, gain better insights into your business’s financial health, and make informed decisions for the future.

One of the standout features of Xero is its ability to automate tasks related to finance. By connecting your bank accounts, Xero can automatically import and categorize your transactions, saving you valuable time and reducing the risk of human error. This automation also extends to invoice management, allowing you to easily create, send, and track invoices, ensuring timely payment from your clients or customers.

Xero’s financial management features also include robust budgeting and forecasting tools. With these tools, you can set financial goals, create budgets, and monitor your progress towards meeting those goals. This level of financial planning and analysis can provide you with a clear understanding of your business’s financial position and help you make strategic decisions to drive growth.

Additionally, Xero offers advanced reporting capabilities. You can generate customizable financial reports, such as profit and loss statements, balance sheets, and cash flow statements, all with just a few clicks. These reports give you a comprehensive view of your business’s financial performance, allowing you to identify trends, analyze expenses, and spot opportunities for improvement.

Lastly, Xero’s financial management features integrate seamlessly with other aspects of your business, such as payroll and inventory management. This integration eliminates the need for manual data entry and ensures that your financial information is always accurate and up to date.

Harnessing the Power of Cloud Accounting

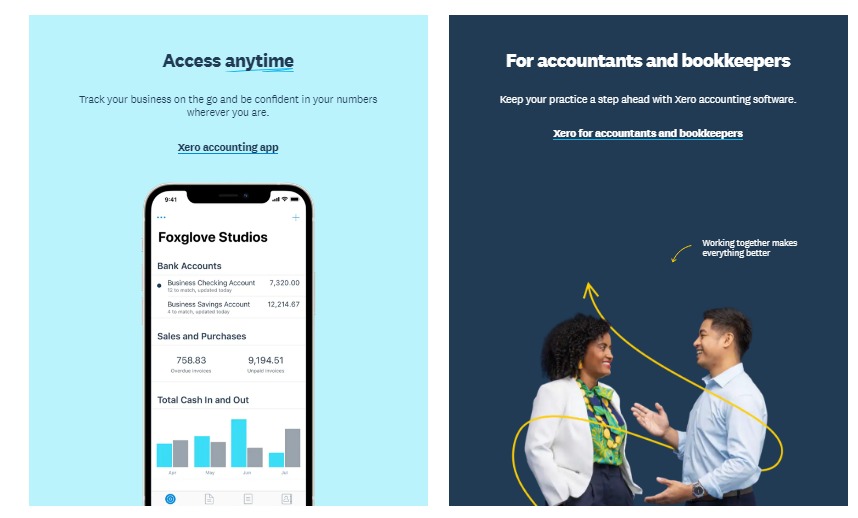

In today’s digital age, cloud accounting has become a game-changer for businesses of all sizes. Xero’s accounting software harnesses the power of the cloud to revolutionize the way you manage your finances. With Xero’s cloud accounting tools, you can access your financial information anytime, anywhere, and from any device with an internet connection.

One of the key benefits of cloud accounting is its flexibility and accessibility. Gone are the days of being tied to your office desk or relying on one computer to access your financial data. With Xero, you can log in to your account from your laptop, tablet, or smartphone, giving you the freedom to manage your finances on the go. Whether you’re meeting with clients, traveling for business, or working from home, you can stay connected to your financial information and make informed decisions in real-time.

Cloud accounting also offers enhanced security and data protection. With Xero, your financial data is stored securely in the cloud, protected by advanced encryption and robust security measures. This eliminates the risk of data loss or theft that comes with storing information on physical servers or local computers. Additionally, Xero performs regular backups, ensuring that your data is safe and can be easily recovered if needed.

Another advantage of cloud accounting is the ability to collaborate and share information seamlessly. Xero allows multiple users to access the same data simultaneously, making it easy to collaborate with your team or external advisors. You can grant different levels of access to each user, ensuring that sensitive financial information remains confidential while allowing others to contribute to the financial management process.

In addition to collaboration, cloud accounting streamlines your financial workflows by automating repetitive tasks. Xero integrates with various banking institutions, allowing you to automatically import and reconcile your bank transactions. This not only saves you time but also reduces the risk of manual errors. You can also automate your invoice management, eliminating the need for manual data entry and ensuring timely payment from your clients.

Cloud accounting offers scalability, making it suitable for businesses of all sizes. Whether you’re a small startup or a large corporation, Xero’s cloud accounting software can grow with your business. You can easily add or remove features as your needs change, without the need for costly upgrades or installations.

Seamless Collaboration with Your Advisor

When it comes to managing your business’s finances, having a trusted advisor by your side can make all the difference. That’s where Xero’s seamless collaboration tools come in. With Xero, you can easily connect and share your financial information with your accountant or bookkeeper, enabling them to provide you with valuable insights and guidance.

Xero’s collaboration features make it easy for you and your advisor to work together in real-time. You can grant your advisor access to your Xero account, allowing them to view and analyze your financial data, generate reports, and provide you with the guidance you need to make informed decisions. This eliminates the need for back-and-forth communication and speeds up the collaboration process.

Additionally, Xero’s collaboration tools enable you and your advisor to communicate and share information securely within the platform. You can leave comments, ask questions, and provide feedback directly on specific transactions or reports. This streamlined communication ensures that everyone is on the same page and reduces the risk of miscommunication or missed messages.

With Xero, you can also give your advisor the ability to handle certain tasks on your behalf. They can perform tasks such as reconciling bank transactions, managing invoices, or generating financial statements without needing to directly access your Xero account. This not only saves you time but also gives you peace of mind knowing that your advisor has the tools they need to efficiently manage your finances.

Seamless collaboration with your advisor is crucial for staying on top of your business’s financial health and making informed decisions. Xero’s collaboration features make it easy to work together, ensuring that you have the support and expertise you need to navigate the complexities of finance. By leveraging these tools, you can unlock your business’s full potential and achieve your goals.

Streamlining Payroll and Human Resources

Managing payroll and human resources can be a time-consuming and complex task for businesses of all sizes. However, with Xero’s accounting tools, streamlining these processes has never been easier. Xero offers a range of features specifically designed to simplify payroll and HR management, allowing you to focus on other important aspects of your business.

One of the standout features of Xero is its integrated payroll system. With Xero Payroll, you can easily set up and manage employee profiles, calculate wages and deductions, and generate pay slips. The software automatically calculates tax withholdings and superannuation contributions, ensuring compliance with local tax regulations. Xero also simplifies the process of submitting payroll information to tax authorities, making it a breeze to stay compliant.

In addition to payroll management, Xero also offers HR functionalities that can help streamline your HR processes. Xero’s HR features allow you to store and manage employee information, track leave balances, and manage time-off requests. The software also enables you to set up custom HR workflows, such as employee onboarding and performance reviews. These tools help automate HR processes and reduce administrative burdens.

Xero’s payroll and HR functionalities integrate seamlessly with other aspects of your business, such as accounting and reporting. This integration ensures that your financial records and HR data are always up to date and accurate. By centralizing your payroll and HR processes within Xero, you can save time, reduce errors, and improve overall efficiency.

With Xero’s streamlined payroll and HR management tools, you can free up valuable time and resources, allowing you to focus on growing your business. By automating repetitive tasks and simplifying complex processes, Xero helps businesses of all sizes efficiently manage their payroll and HR functions. Whether you have a handful of employees or a large workforce, Xero’s accounting tools can help you streamline your payroll and HR processes and ensure compliance, ultimately contributing to the success of your business.

Making Tax Time Less Taxing

Tax season can be one of the most dreaded times of the year for business owners. The complexities of tax regulations and the fear of making costly mistakes can be overwhelming. However, with Xero’s accounting tools, tax time doesn’t have to be a source of stress. Xero offers a range of features that can help make tax preparation and compliance a breeze.

One of the key features that sets Xero apart is its integration with tax software and services. With just a few clicks, you can seamlessly connect your Xero account to popular tax software providers, such as TurboTax or TaxJar. This integration allows for easy transfer of financial data, making it simple to generate accurate tax returns and comply with local tax regulations. Xero also offers built-in tax reports and calculators, so you can stay organized and confident in your tax preparations.

In addition to tax software integration, Xero’s accounting tools also help automate many of the manual tasks associated with tax preparation. Xero can automatically categorize and track your expenses throughout the year, making it easier to identify deductible expenses and maximize your tax savings. The software also generates detailed financial reports, such as profit and loss statements, which provide a comprehensive overview of your business’s financial performance and help ensure accurate tax filings.

Another advantage of Xero’s accounting tools is the ability to store and access your tax documents securely in the cloud. Xero’s cloud-based platform allows you to easily upload and organize important tax-related documents, such as receipts, invoices, and financial statements. This eliminates the need for physical paperwork and reduces the risk of losing or misplacing important documents during tax season.

With Xero’s accounting tools, you can approach tax time with confidence and ease. By automating manual tasks, integrating with tax software, and providing comprehensive tax reports, Xero helps streamline the tax preparation process and ensures accurate and timely tax filings. Say goodbye to hours spent poring over spreadsheets and stressing about tax compliance – with Xero, tax time can be less taxing and more manageable.

Comprehensive Reporting and Business Insights

When it comes to managing your business’s finances, having access to comprehensive reporting and business insights is crucial. This is where Xero’s accounting tools truly shine. With Xero, you can generate a wide range of customizable financial reports that provide you with a comprehensive view of your business’s financial performance.

From profit and loss statements to balance sheets and cash flow reports, Xero’s reporting capabilities allow you to track your business’s income, expenses, and cash flow in real-time. This level of visibility into your financial data is essential for making informed decisions and identifying areas for improvement.

But Xero’s reporting features go beyond just standard financial statements. The software also offers advanced analytics and insights that help you dig deeper into your financial data. With Xero’s reporting tools, you can analyze trends, compare periods, and identify key performance indicators that impact your business’s success. This information allows you to make strategic decisions to drive growth and optimize your financial performance.

Additionally, Xero’s reporting capabilities enable you to monitor key metrics and benchmarks specific to your industry. This gives you the ability to benchmark your business’s performance against industry standards, identify areas where you’re excelling, and pinpoint opportunities for improvement.

With Xero’s comprehensive reporting and business insights, you have the power to take control of your finances and make data-driven decisions. Whether you need to track your cash flow, analyze your profitability, or evaluate the success of a marketing campaign, Xero’s reporting tools provide you with the information you need to make informed choices and propel your business forward.

Is Xero Worth the Investment?

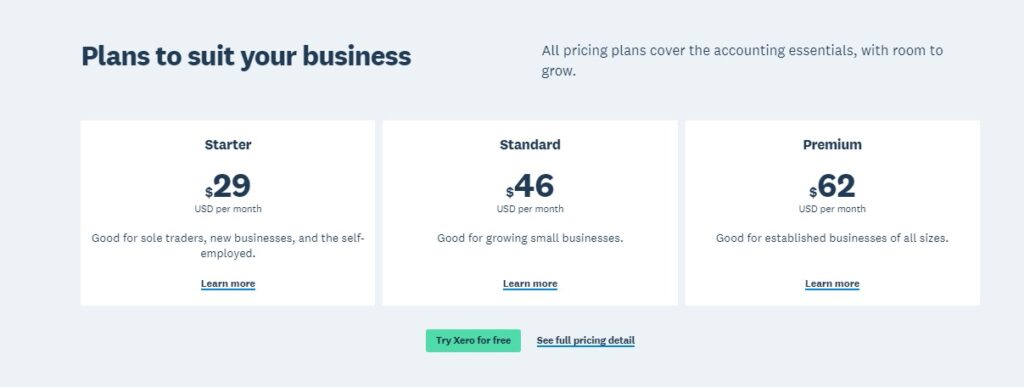

When considering any investment for your business, it’s natural to question whether it will truly be worth it. So, is Xero worth the investment? The short answer is yes. Xero’s accounting tools offer a wide range of features and benefits that can significantly impact the success of your business.

First and foremost, Xero’s revolutionary approach to accounting provides accessibility and user-friendliness, making it easy for even those with limited accounting experience to navigate and utilize its features. This alone can save you time and reduce the risk of errors. Additionally, Xero’s real-time financial reporting capabilities give you valuable insights into your financial health, helping you make informed decisions and plan for the future.

Xero’s financial management features are another reason why it’s worth the investment. With tools that automate tasks, such as importing and categorizing transactions or managing invoices, you can streamline your financial processes and gain better insights into your business’s financial health. Xero also integrates seamlessly with other aspects of your business, such as payroll and inventory management, eliminating the need for manual data entry and ensuring accuracy.

The power of cloud accounting cannot be understated, and Xero harnesses this power to make managing your finances easier and more flexible than ever before. With the ability to access your financial information anytime, anywhere, and from any device, you can stay connected and make informed decisions on the go. Cloud accounting also offers enhanced security and data protection, giving you peace of mind.

Lastly, Xero’s collaboration features make working with your advisor seamless and efficient. With the ability to share information securely within the platform and grant access to specific tasks, you can easily collaborate with your advisor and receive valuable insights and guidance.

In conclusion, Xero is worth the investment. Its comprehensive features, user-friendliness, cloud-based capabilities, and seamless collaboration options make it an invaluable tool for any business looking to streamline their financial processes, gain insights, and unlock their full potential. Don’t let outdated methods of accounting hold you back – invest in Xero and take your financial management game to new heights.